Which message is more likely to get a reply: a cold pitch out of nowhere, or one sent just hours after a prospect announces a funding round? The reply rate jumps when you time outreach to a clear business event. Timing creates context.

Reports show trigger-based campaigns can significantly outperform cold outreach. A 2020 benchmark reported up to 497% higher engagement in specific use cases, though your results will vary by audience and channel.

This guide gives you 35+ actionable sales triggers to help you build timing-driven sequences that generate leads and convert potential customers into real pipeline.

What are sales triggers and why they matter

Sales triggers are events inside or around a target company that indicate a shift in priorities, budget, or readiness to buy. These triggers can be internal, like job changes, funding rounds, or new tech adoption, or external, like market shifts or major industry developments.

In modern outbound prospecting workflows, they help reps identify high-intent accounts, personalize their outreach, and hit quota with fewer touches.

Why do they work? Because change makes prospects more open to re-evaluating priorities and considering solutions that fit their new goals.

Trigger-based vs. traditional prospecting: quick comparison

| Metric | Traditional Prospecting | Trigger-Based Prospecting |

|---|---|---|

| Response rate | 2% for cold calls 1-5% for cold emails | Often higher response rates than cold outreach (teams report 2–5x in some cases) |

| Time to close | Longer cycles due to poor timing | Faster sales cycle for outreach based on timely events (one analysis reported up to 23% in certain segments) |

| Conversion rate | Typically under 1% for cold outreach | Higher conversions due to personalization and timely outreach |

The 15 highest-impact sales triggers

1. New executive appointments (C-suite, VPs)

Why it works: New C-level hires often reset priorities. They revisit vendor relationships, rework strategies, and explore tools that align with their vision.

How to track the sales trigger:

- LinkedIn updates and press releases

- Industry news

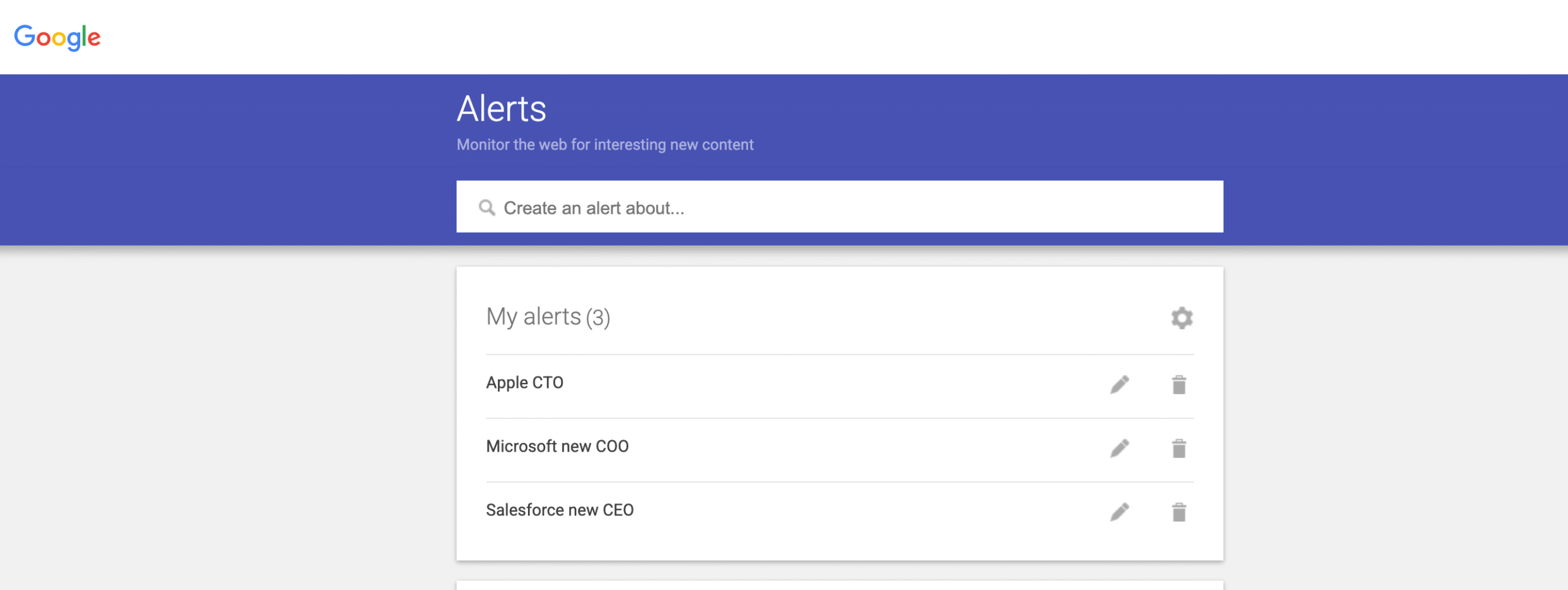

- Google Alerts for “[company name] + appoints” or “[industry] + new CEO”

Outreach angle: Highlight quick wins tied to their past experience, and show how your solution helps them drive early impact in their new role.

Best timing: 30–60 days post-appointment after onboarding noise settles but before they lock in long-term vendor decisions.

2. Key hire announcements (department heads, specialists, new C-suite executives)

Why it works: Department-level hires reveal where a company is actively investing. A new VP of Sales often signals pipeline growth initiatives, while a Head of IT can indicate sales opportunities for a CI/CD tool.

How to track:

- Company websites and career boards

- Use Boolean queries like “Head of [Department]” AND [Company]

- Industry trade publications

Outreach angle: For sales leaders, show how you shorten ramp and lift meeting rates. For technical leaders, highlight your SSO, security posture, and native CRM/ATS integrations.

Best timing: 60–120 days after hiring, when they’re assessing existing tools and shaping departmental priorities.

3. Title and role changes (promotions, lateral moves)

Why it works: Newly promoted leaders carry the pressure to prove value fast. They’re often handed fresh performance metrics, budget, and a short runway to show impact.

How to track job changes:

- LinkedIn Sales Navigator‘s “Spotlight → Changed jobs in last 90 days” with title filters like “Head,” “VP,” or “Lead”

- PhantomBuster’s HubSpot Contact Career Tracker to automatically monitor job changes across your HubSpot contact list. Where lawful, it enriches profiles with updated job titles, business emails, and start dates for compliant outreach, and refreshes key fields like lifecycle stage and company details for targeted outreach.

Outreach angle: Congratulate them and offer a concise playbook or a short audit tailored to their new remit.

Best timing: 30–60 days after the role change, when they’re exploring tools to define success in their new lane. Earlier, and you’re noise.

4. Employee departures (especially decision makers)

Why it works: Key departures create leadership gaps and opportunities for new decision-makers to evaluate vendor relationships, reframe value props, or offer continuity and procurement decisions.

How to track:

- Team pages, company PRs, and “People Moves” newsletters for leadership churn

- Industry news

Outreach angle: Reconnect with remaining stakeholders, citing the change and offering to support continuity or reassess fit. “With [Name] moving on, happy to revisit how we can support [goal] moving forward.”

Best timing: Within 2–4 weeks of the departure for the old company (before ownership resets)

5. Funding rounds (Series A-D, IPO preparations)

Why it works: Funding signals incoming revenue and growth plans. Series A signals aggressive hiring and GTM acceleration, while Series C+ or IPO prep suggests maturity, scalability, and operational tooling needs. Each stage maps to a different kind of solution urgency.

How to track:

- Industry news

- Crunchbase Pro, Dealroom, and TechCrunch for round announcements

- Google Alerts for phrases like “raises Series B” or “[company] IPO”

Outreach angle: Tailor messaging based on round: pitch speed, GTM velocity, and onboarding value for early-stage; focus on scalability, compliance, and efficiency for late-stage.

Best timing: 2–8 weeks after announcement when budget conversations are underway but tools and vendors are still being evaluated.

6. Quarterly earnings (positive/negative results)

Why it works: Financial performance directly impacts purchasing decisions. Strong earnings indicate budget availability, while poor results signal need for efficiency solutions.

How to track:

- SEC 10-Q filings, earnings call transcripts, and investor decks

- Earnings calendars via Seeking Alpha, Yahoo Finance, and TradingView

- Visualping to auto-monitor investor relations pages for public companies

Outreach angle: For strong results: position your solution as a way to scale momentum. For weak results: highlight cost reduction, consolidation, or workflow efficiency.

Best timing: 1-2 weeks after earnings announcement

7. Mergers and acquisitions (as buyer or target)

Why it works: M&A activity leads to overlapping teams, tool redundancies, and shifting priorities. It’s also when new leadership steps in and reevaluates vendor contracts.

How to track:

- New research releases and industry news

- M&A coverage on PitchBook, Mergermarket, and CB Insights

- SEC 8-K filings for public company disclosures

Outreach angle: Focus on integration support, vendor consolidation, and solutions for achieving strategic objectives. If relevant, include a short case study on a similar M&A situation you’ve supported.

Best timing: 3–6 months post-announcement, during the heat of integration planning.

8. New office locations and company relocations

Why it works: Indicate upcoming headcount growth, robust company financial performance, IT provisioning, and local vendor sourcing.

How to track:

- Local business journals, real estate listings, and city permitting websites

- Propmodo or LoopNet for commercial lease activity

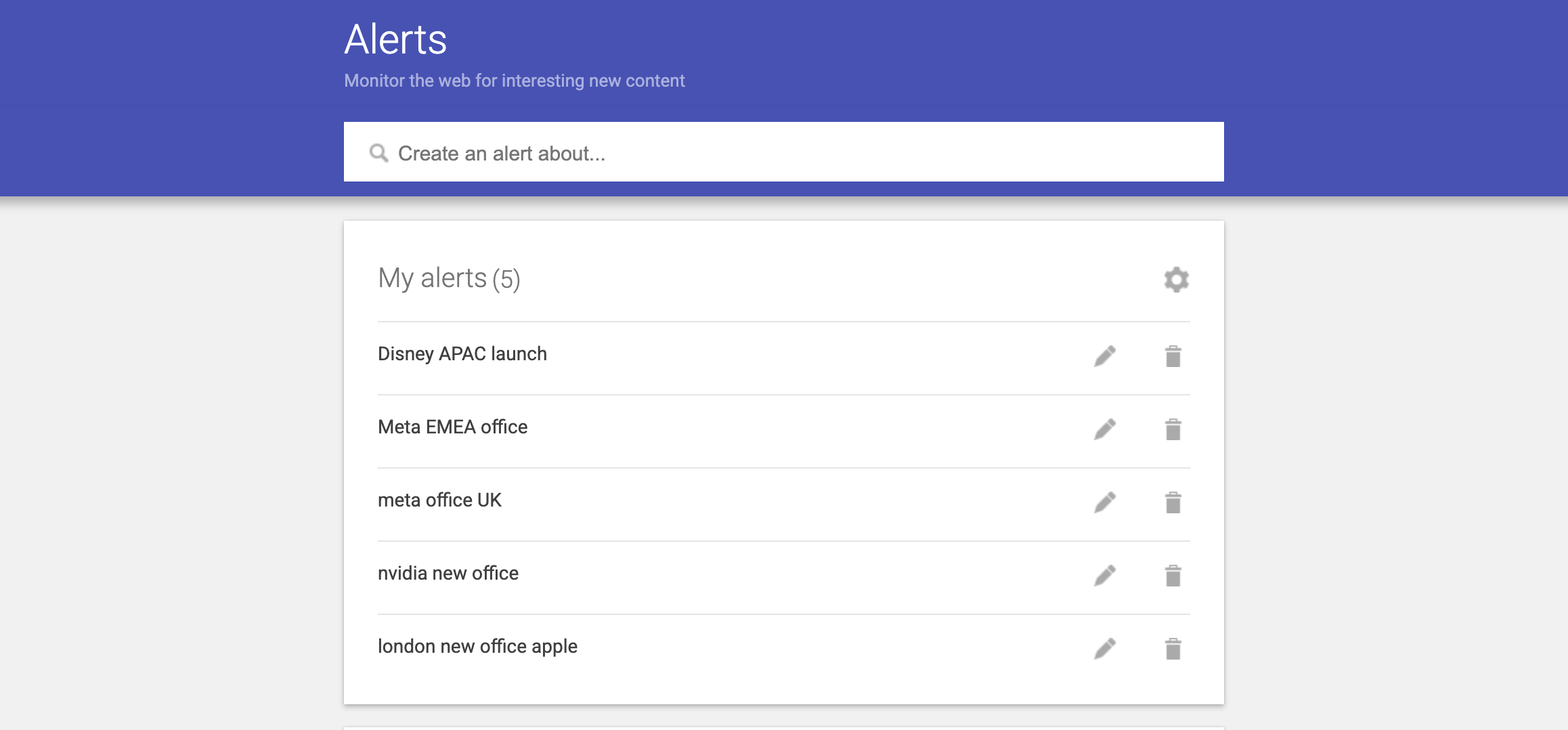

- Google Alerts for “[company] new office [city]” or “expanding to [region]”

Outreach angle: Offer help with vendor ramp-up, office IT setup, or onboarding support. Mention nearby client stories to build trust.

Best timing: 1–3 months before opening, while they plan infrastructure

9. Product launches

Why it works: New products create opportunities for complementary solutions, supporting services, marketing tools, and technical infrastructure.

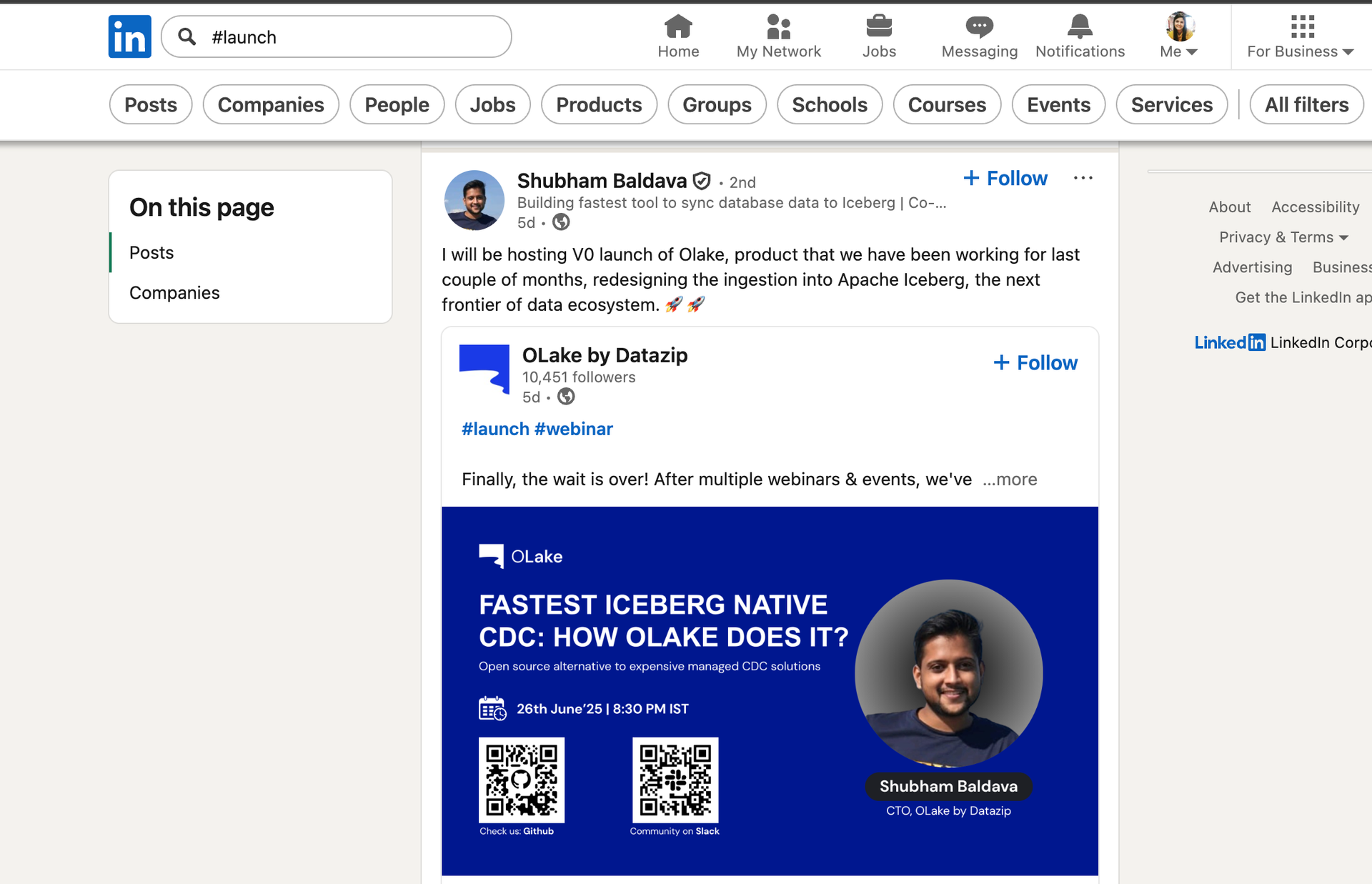

How to track:

- Product Hunt, BetaList, and industry news

- Monitor posts tagged #launch or #nowlive

Outreach angle: Frame your offer as a launch booster: show how you help teams track success metrics or improve onboarding.

Best timing: During the pre-launch push or within the first 30 days of release.

10. Market expansion (geographic or vertical)

Why it works: Expansion into new markets creates challenges requiring localization, compliance tools, market research, and industry-specific solutions.

How to track:

- Geo-tagged job posts (e.g., “Account Exec – DACH”)

- Press releases and investor decks

- Payroll, HR, and legal/compliance roles on LinkedIn

Outreach angle: Lean into your specialization: call out common market-entry friction (e.g., hiring, GTM, compliance) and show how you’ve solved it in that geography or vertical before.

Best timing: During planning or hiring phase, before they go live in the new market.

11. Technology stack changes

Why it works: Technology adoption signals changing priorities and creates integration opportunities, training needs, and complementary solution requirements.

How to track:

- Job postings that mention specific tools (e.g., “experience with Snowflake”)

- BuiltWith or Wappalyzer for tech stack changes on public websites

- GitHub release notes and industry news

Outreach angle: Highlight integration capabilities, plug-in compatibility, or enablement services.

Best timing: During implementation phase (1-3 months after adoption)

12. Digital transformation initiatives

Why it works: These programs have clear budgets and executive sponsorship. They require phased rollouts and multiple vendors, which opens a window to position your solution early.

How to track:

- Conference presentations by CIOs, CTOs, or Heads of Transformation

- Job openings for transformation roles, cloud migration, or enterprise architects

Outreach angle: Highlight how your offering supports modular adoption, cloud readiness, or employee upskilling for digital-first workflows. Share relevant testimonials and social proof.

Best timing: Early planning phase before vendor selection

13. Regulatory landscape and new legislation

Why it works: New legislation forces process adaptation, creating urgent compliance needs that bypass normal procurement timelines.

How to track:

- Government sites and regulatory authority updates (U.S.: SEC, FTC; EU: EU Commission/EDPB; industry regulators as applicable)

- Legal newsletters or alerts from sources like Lexology or Mondaq

Outreach angle: Highlight fast implementation, compliance-readiness, and deep domain expertise. Bonus if you have worked with others in the same industry under similar mandates.

Best timing: 3–6 months ahead of the enforcement deadline.

14. Competitor actions (new products, acquisitions, failures)

Why it works: Create urgency for companies to respond with counter-initiatives and strategic responses.

How to track:

- Axios Pro Rata, Techmeme, and other industry publications

- Track exec-level LinkedIn posts reacting to competitor news

- Use social listening to gauge sentiment and how serious the competitive threat is

Outreach angle: Frame your product as a competitive equalizer: “We’ve helped teams react quickly to [X] by enabling faster GTM cycles or better differentiation.” Follow up with social proof.

Best timing: 2–4 weeks after the competitor move.

15. Commenting on or engaging with your company posts or influencer content

Why it works: It gives you direct insight into interest, lets you acknowledge their strong market position, and opens the door for warm introductions.

How to track:

- Native LinkedIn or Twitter analytics dashboards

- LinkedIn Activity Extractor to collect info around latest posts from a specific profile’s recent LinkedIn activity

- Social listening platforms like Brandwatch or Sprout Social for influencer interactions

- PhantomBuster’s LinkedIn Post Commenter & Liker Scraper to automatically track who’s engaging with your (or your competitor’s) posts on LinkedIn. It collects publicly available names, roles, and profile URLs of people who like or comment on posts, so you can trigger context-rich outreach responsibly.

Outreach angle: Reference the post or topic they engaged with and offer deeper value like a related resource or brief POV on the subject.

Best timing: Within 24-48 hours of engagement

16. Event or webinar signup

Why it works: Registration signals active interest in specific topics and provides excellent conversation starters.

How to track:

- PhantomBuster’s LinkedIn Event Guests Export to export attendee lists with job titles, names, and profile URLs (from publicly available event pages). Perfect for identifying high-intent prospects based on the topics or formats they’re actively showing up for.

- Use platform exports or consented registrations (e.g., Zoom/ON24 CSVs)

- LinkedIn Profile URL Finder to match signups with attendee lists from external platforms like Zoom. Feed the list into the automation and it will find the right LinkedIn profiles against your leads.

Outreach angle: Offer a relevant follow-up guide, framework, or tailored insight.

Best timing: 1–2 weeks before the event while they prep, or within 7 days after while it’s top of mind.

17. Awards and recognition

Why it works: Signals positive momentum and often signals increased budgets for maintaining competitive advantage.

How to track:

- Follow award sites in your vertical (e.g., G2, Gartner, Fast Company)

- Google Alerts like “wins [award]” or “[company name] recognized”

- Company blogs and PR feeds

Outreach angle: Congratulate them, then show one way you can help, e.g., automate follow-ups to new signups or surface high-intent segments from the influx of attention.

Best timing: Within 1–2 weeks of the announcement, when the win is still fresh and energy is high.

Quick reference: 20+ additional sales triggers

People and leadership triggers

| Trigger Event | Description | Primary Tracking Method | Best Timing | Ideal Solutions |

|---|---|---|---|---|

| Leadership departures | Executive turnover | Industry newsletters (The Org, ExecWire), PR announcements | After replacement announcement | Interim execution support, transition consulting |

| Layoffs | Signal budget reallocations, tooling cuts, or outsourcing shifts | News articles, Layoffs.fyi, Blind | 2-4 weeks after announcement | Process automation, external service partners |

Financial and business triggers

| Trigger Event | Description | Primary Tracking Method | Best Timing | Ideal Solutions |

|---|---|---|---|---|

| Venture capital backing | GTM blitzes, hiring sprees, and tooling upgrades | Crunchbase, PitchBook, VC firm blogs | Within 1 month of announcement | Growth tools, scaling solutions |

| Stock decreases | Triggers vendor renegotiations, hiring freezes, and tool consolidation | TradingView, Google Finance alerts, investor Slack channels | 1-2 weeks after significant drops | Cost-saving solutions, efficiency tools |

| Acquisition targets | Companies being acquired | SEC M&A filings, financial news (Reuters M&A wire) | During due diligence period | Integration services, compliance tools |

Product and market triggers

| Trigger Event | Description | Primary Tracking Method | Best Timing | Ideal Solutions |

|---|---|---|---|---|

| Patent filings | New intellectual property protection hints at upcoming product lines or tech expansion | Google Patents, USPTO, EPO Espacenet, and WIPO PATENTSCOPE | 1-2 months after filing | Legal services, IP commercialization, R&D tooling |

| Major client wins | New use cases, increased service demands, and PR leverage | Press releases, case studies | Within 1 week | Scaling solutions, customer success tools |

| Product recalls | Quality issues | U.S. CPSC, FDA recall feeds, EU RAPEX, company announcements | Immediately after announcement | Quality assurance, crisis management |

| New market entry | Geographic/vertical expansion | Geo-tagged job posts (e.g., “BDR – Dubai”), regional press, Crunchbase | During expansion phase | Localization services, market research |

| International expansion | Triggers procurement resets, legal/regulatory compliance | Import/export filings, localized career pages, foreign entity registration notices | During planning phase | Compliance tooling, in-market partner enablement |

Operational and reputation triggers

| Trigger Event | Description | Primary Tracking Method | Best Timing | Ideal Solutions |

|---|---|---|---|---|

| Patent filings | New intellectual property protection hints at upcoming product lines or tech expansion. | Google Patents, USPTO/ESPA registers, monitoring tools like PatentScope | 1-2 months after filing | Legal services, IP commercialization, R&D tooling |

| Major client wins | New use cases, increased service demands, and PR leverage | Press releases, case studies | Within 1 week | Scaling solutions, customer success tools |

| Rebrandings | Often pair with positioning shifts, new messaging, or leadership changes | Domain redirects, Favicon/logo changes (use Visualping), Dribbble/Behance design updates | During transition period | Web design, messaging alignment, SEO/analytics |

| Layoffs | Signal budget reallocations, tooling cuts, or outsourcing shifts. | News articles, Layoffs.fyi, Blind | 2-4 weeks after announcement | Process automation, external service partners |

| Website redesigns | Digital presence updates | Visualping, built-in changelog monitors, Wappalyzer | During dev or QA phase pre-launch | Analytics setup, CRO tools |

| Security breaches | Cybersecurity incidents | Data Breach Today, Cyberwire, HaveIBeenPwned, SEC incident reports | Immediately after disclosure | Security solutions, compliance tools |

| Negative reviews | Customer dissatisfaction, decrease in loyal customer base | G2, TrustRadius, Reddit or X complaints | Within 1–3 days of a negative-review trend | Customer success tools, reputation management |

| Partnership announcements | Strategic alliances | Industry news, Crunchbase alerts, LinkedIn mentions | Within 2 weeks | Integration services, complementary tools |

| Conference hosting | Industry event organization+ account-based engagement moment | LinkedIn Events tab, marketing calendars, email invites | 2-3 months before event | Event services, marketing support |

| Analyst reports | Third-party research mentions | Analyst websites like Gartner, Forrester, IDC, GigaOM radar drops, Reddit summaries | Within 1 month of publication | Advisory services, readiness audits |

| Stock decreases | Triggers vendor renegotiations, hiring freezes, and tool consolidation | TradingView, Google Finance alerts, investor Slack channels | 1-2 weeks after significant drops | Cost-saving solutions, efficiency tools |

| New market entry | Geographic/vertical expansion | Geo-tagged job posts (e.g. “BDR – Dubai”), regional press, Crunchbase | During expansion phase | Localization services, market research |

| Acquisition targets | Companies being acquired | SEC M&A filings, financial news (Reuters M&A wire) | During due diligence period | Integration services, compliance tools |

| Leadership departures | Executive turnover | Industry newsletters (The Org, ExecWire), PR drops | After replacement announcement | Interim execution support, transition consulting |

| Product recalls | Quality issues | U.S. CPSC, FDA recall feeds, EU RAPEX, company announcements | Immediately after announcement | Quality assurance, crisis management |

| Venture capital backing | GTM blitzes, hiring sprees, and tooling upgrades | Crunchbase, PitchBook, VC firm blogs | Within 1 month of announcement | Growth tools, scaling solutions |

| International expansion | Triggers procurement resets, legal/regulatory compliance | Import/export filings, localized career pages, foreign entity registration notices. | During planning phase | Compliance tooling, in-market partner enablement |

| Environmental initiatives | Sustainability programs | CSR/sustainability reports, ESG rating site updates | During program launch | Green technology, compliance solutions |

| Customer churn increases | Retention challenges | Analyst calls, G2 downticks | When trends become public | Customer success tools, retention platforms |

| Technology partnerships | Tech integration announcements | Technology publications, partner sites | During integration period | Complementary solutions, support services |

Partnership and event triggers

| Trigger Event | Description | Primary Tracking Method | Best Timing | Ideal Solutions |

|---|---|---|---|---|

| Partnership announcements | Strategic alliances | Industry news, Crunchbase alerts, LinkedIn mentions | Within 2 weeks | Integration services, complementary tools |

| Technology partnerships | Tech integration announcements | Technology publications, partner sites | During integration period | Complementary solutions, support services |

| Conference hosting | Hosting an industry event creates a strong ABM moment to engage target accounts | LinkedIn Events tab, marketing calendars, email invites | 2-3 months before event | Event services, marketing support |

| Analyst reports | Third-party research mentions | Gartner, Forrester, IDC, and GigaOm Radar reports | Within 1 month of publication | Advisory services, readiness audits |

| Environmental initiatives | Sustainability programs | CSR/sustainability reports, ESG rating site updates | During program launch | Green technology, compliance solutions |

How to track and act on these sales triggers

Implementing a trigger-based sales approach involves several actionable steps:

1. Automate data collection

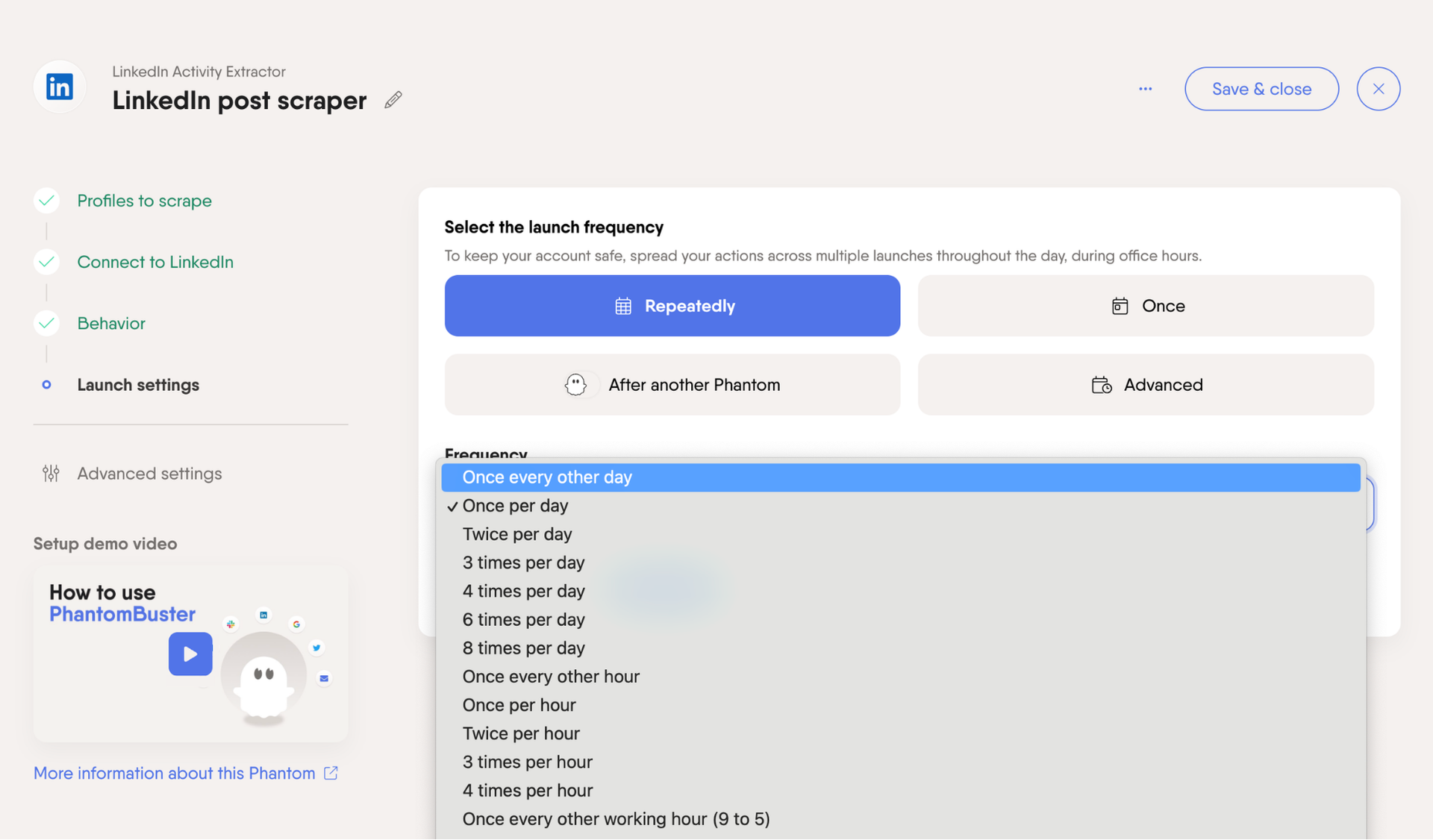

Start by setting up PhantomBuster to monitor exec posts and company updates, then alert your team or push to your CRM. You can complement this with Google Alerts for press hits, but PhantomBuster’s LinkedIn Activity Extractor offers a faster, automated way to monitor trigger signals directly from where buyers are most active.

2. Filter and prioritize leads

Scoring leads based on trigger strength helps you focus on what’s most likely to convert. Pipe the monitored profiles into PhantomBuster’s AI LinkedIn Profile Enricher within the same workflow to score leads by trigger strength (e.g., funding + VP hire).

3. Personalize outreach

Reference the event directly and tie it to the outcome you enable. Your message should reflect the specific event and tie directly to your value proposition.

For example, if a VP of Sales just joined a Series B HR tech company, don’t send a generic pitch. A stronger message would be:

Congrats on the new role. I noticed your team’s expanding into mid-market. One of our clients in HR tech cut SDR ramp time by 40% post-Series B. Happy to share how.

In the same workflow, use PhantomBuster’s AI Message Writer to draft a first touch that references the trigger and your value prop. Review, personalize, and send. It adapts messaging based on your tone, profile details fed in the prompt, and the real trigger data you’ve collected.

This way, you spend less time writing and more time closing.

4. Monitor results and refine

To maximize the ROI of your trigger-based outreach, you need to track both performance metrics and feedback to understand which signals are actually driving results. Focus on metrics like:

- Response rate by trigger type

- Time-to-first-touch

- Meeting-to-opportunity conversion

- Prospect sentiment in replies

Overcoming common pitfalls when using sales triggers

Even the most sophisticated trigger monitoring systems can fail without proper execution. Here are the key challenges to avoid when implementing trigger-based prospecting:

- Data privacy concerns: Automation at scale doesn’t excuse compliance shortcuts. Avoid collecting information behind login walls or using tools that bypass platform security. Platforms like LinkedIn can restrict accounts for repeated violations. Stick to publicly available data and follow their terms. Focus on signals that are publicly accessible without authentication, and ensure data flows cleanly into your CRM with clear consent handling.

- Trigger fatigue: When everyone jumps on the same trigger, it loses impact. If a funding round is trending on LinkedIn, your prospect has likely received a dozen similar messages. Prioritize quieter, high-context triggers like internal role shifts, team growth patterns, or sudden tech stack changes that aren’t blasted across the news cycle.

- False positives: A title change or a new partner logo on a site doesn’t always mean buying intent. Look for supporting signs: team hiring, active product launches, budget shifts before reaching out. Triggers should start a hypothesis, not guarantee a sale.

- Timing missteps: Some triggers like job change need fast action. Others, like M&A and region expansion require patience. Map response timing to trigger type so your outreach aligns with when prospects are most receptive.

FAQ

Which sales trigger events have the highest conversion rates?

Leadership changes and funding announcements typically produce the highest conversion rates. These trigger events often signal a shift in strategy, making them ideal touchpoints for well-timed outreach or relevant marketing efforts.

How quickly should I respond to a sales trigger?

Aim to reach out within 24–48 hours of the trigger event. This keeps your message timely and relevant before others jump in.

Can I automate sales trigger monitoring to increase sales?

You can automate sales-trigger monitoring with PhantomBuster automations that monitor publicly available LinkedIn updates, profile activity, and company signals from social channels.

How can small sales teams effectively monitor triggers without getting overwhelmed?

Focus on a few high-impact triggers that align with your ICP, such as job changes, funding rounds, or tech adoption. Use automation like PhantomBuster to track sales triggers across multiple sources. This helps your team stay lean while still capitalizing on potential trigger events that matter most.

What’s the difference between sales triggers and buying signals?

Sales triggers are external events like funding or new hires. Buying signals, in contrast, are behavioral actions like site visits or demo requests that show active interest.

How many triggers should I monitor per prospect?

Stick to 3–5 relevant, high-impact sales trigger events per prospect. Too many create noise; the goal is to focus on the few trigger events that directly relate to timing, budget, and the prospect’s evolving needs.